The German financial sectors has been hit hard by the European debt crisis and rumors are now emerging of more and more financial institutions that lack the capital to withstand more pain. Even if they are not in the top 4 banks by Italian and Greek debt holdings (the bonds that were hit by far by the recent debacle), Deutsche Bank, through its North American Taunus Group and Commerzbank are maintaining toxic Euro-debt at a very thin capitalization. I am talking here about contagion at the very core of the European Union.

Deutsche Bank

As reported by Bloomberg, Taunus Corp., which is according to FED, the eight largest bank holding company in the US, as measured by its $380 billion asset pool. The subsidiary of Deutsche Bank has considerable exposure of the two most toxic assets still not written off: peripheral European debt and US mortgage backed securities. By any means, this is a factor of concerns.

Even if Deutsche Bank is a giant among giants, with its $3.08 trillion asset base, its third quarter capitalization equaled only EUR51.9 billion, bringing to a leverage ratio of 44, close to the leverage ratio of Lehman Brothers, soon before its collapse. Furthermore, Taunus Group is holding only $4.87 billion in capital, implying a crazy 78 leverage ratio. More from Bloomberg:

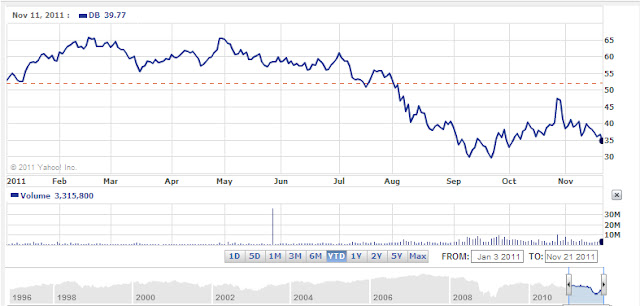

Needless to say, the stock has not fared very well until now, down 36.74% for this year:Globally, Deutsche’s capital ratios are relatively healthy, judging by the banking industry’s standard measures. At the end of the third quarter, its Tier 1 capital ratio was 13.8 percent (up from 12.3 percent at the end of 2010) and its core Tier 1, which excludes hybrid debt that can convert into equity, was 10.1 percent.

How does such a highly leveraged bank become “well- capitalized”? The answer is that “risk-weighted assets” were 337.6 billion euros as of Sept. 30. But what is a low risk- weight asset in the European context today? Incredibly, it is sovereign debt, which of course is far from riskless at the moment.

Perhaps Deutsche Bank holds mostly German government debt, which still has safe-haven value. But it’s likely that Deutsche also holds a significant amount of Italian and French government bonds.

Commerzbank

Commerzbank is the second most undercapitalized German bank and , as reported in one of the previous articles, its Eur 11.7 billion Italian debt exposure is hanging like Damocles' Sword. The bank is struggling to raise Eur5 billion in capital to satisfy capital requirements of 9% suggested by the European Banking Authority (EBA). Compound this with a reported Eur 700 million loss in the third quarter, and this may spill out into something bigger. Meanwhile, the shares have plummeted by more than 16% today to 1.13 and almost 80% year to date.

Is this the time to buy into weakness ? Definitely not, because there is more coming.

No comments:

Post a Comment