To QE or not to QE? This is the question. No definite answer is still firmly enunciated, but all odds are in favor of another round of CTRL+ Print. Why? Too put it quite simply, because the massive US debt needs to be financed in some manner, and the easiest way to get away from this Damocles` sword is through a combination of inflationary devaluation and exchange rate manipulation. All under the noble banner of stimulating the economy. Now, why is this even important? It`s probably related to the narrow-minded "traders`" obsession with the term quantitative easing. Upon hearing mere hints or allusions towards more printing, the market turns haywire: launching in 5...4...3...2...1. The side-effects of such a policy of wealth redistribution are inflated asset prices and accumulated cash piles at the corporate level (which incidentally are usually left to "compound" in this negative rate environment).

Bernanke speech

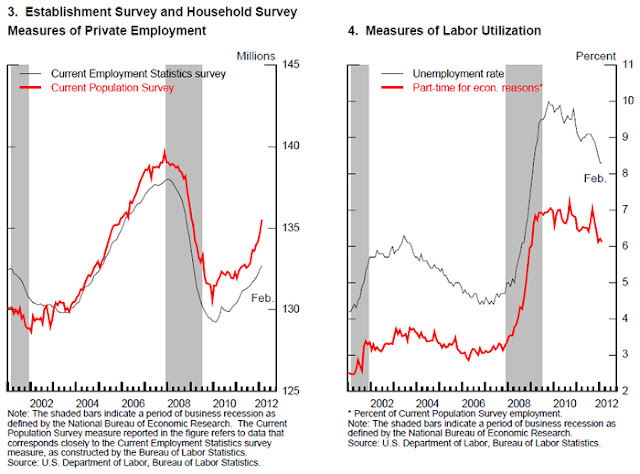

Much of the Fed chairman`s lecture today revolved around the comparative analysis between the unemployment rate and the slow pace of the economic recovery (if one may call a patient on life support, that he is in convalescence). More specifically, why is the unemployment rate declining when the economic indicators signal an expansion at a far lower pace? If this were an scientific experiment one might first put into question the validity of the data and the accuracy of measurement before venturing into a hypothesis. But of course this is real life and who are we to question the validity of the unemployment numbers, or the accuracy of the indicators of "economic recovery"?

"Importantly, despite the recent improvement, the job market remains far from normal; for example, the number of people working and total hours worked are still significantly below pre-crisis peaks, while the unemployment rate remains well above what most economists judge to be its long-run sustainable level. Of particular concern is the large number of people who have been unemployed for more than six months. Long-term unemployment is particularly costly to those directly affected, of course. But in addition, because of its negative effects on workers' skills and attachment to the labor force, long-term unemployment may ultimately reduce the productive capacity of our economy"

Reminder: the official unemployment rate, reflects the number that are currently on state benefits, and not the number of people without a job, or underemployed. It is therefore a proxy for assessing the burden of unemployment benefits upon the state budget rather then a proxy for the overall health of the economy. People giving up on searching for jobs and people who had their 6 month unemployment benefits expire are not included in the official unemployment rate.

After round of massive monetary stimulus, the official unemployment rate declined from 9%, the figure around which it hovered for most of last year, to 8.3% in February this year. It resembles, to steal one of Peter Schiff`s analogies, a patient with a massive bleeding wound for which the doctors prescribe more and more blood transfusions.

Now, because the unemployment and more importantly long term unemployment may leave some deep scars on the face of the US economy, FED will need to ensure that all is done to take care of this chronic ailment, and according to Okun`s law, in order for the unemployment to drop, the economy needs to expand at more rapid pace than its potential rate. Therefore we need more stimulus, and the only weapon left in the arsenal is the bazooka (which by the way missed twice): QE, or simply put, printing.

Gold

Because inflation will at one point catch up with the rate of the monetary expansion (as the freshly created money enters the real economy and the multiplier effect comes into force), and because gold price is very much influenced the inflation expectations, it is poised to fare well in a negative interest rate environment (caused by manipulated nominal rates, together with an inflationary environment). The fact that it burst through the 200DMA today and by the looks of it will close above that level is signalling another bullish leg. Many things might happen with gold, but one thing is certain, the US government needs to finance its massive budget deficit and its massive public debt somehow, and actually repaying the debt is not on top of its list.

No comments:

Post a Comment